GSTR-3B Return – Online Filing Procedure

GSTR-3B Return – Online Filing Procedure

GSTR-3B return must be filed by all persons having GST registration in the month of August and September. GSTR-3B return is due on the 20th of August and September 2017. In this article, we look at GSTR-3B return filing in detail along procedure for filing online.

Who should file GSTR-3B return?

GSTR-3B return must be filed by all person registered under GST until the normal schedule for filing of GST return commences in the month of October 2017.

What is the due date for filing GSTR-3B return?

GSTR-3B return is due on the 20th of August and 20th of September 2017. From October 2017, the taxpayers would be required to file GSTR-1, GSTR-2 and GSTR-3, as per normal schedule. Hence, GSTR-3B is a temporary return that must be filed monthly until October, 2017.

What is the penalty for not filing GSTR-3B return?

The Government has mentioned that during the GST transition period, leniency would be shown to taxpayers to famliarize themselves with the GST provisions. Hence, no penalty has so far been announced for not filing GSTR-3B return. However, it is expected that taxpayers who fail to file GSTR-3B returns would be ineligible to being filing GSTR-1, GSTR-2 and GSTR-3 returns from the month of October. Failure to file GSRT-1, GSTR-2 and GSTR-3 returns will attract penalty of Rs.100 per day.

What details must be provided in GSTR-3B return?

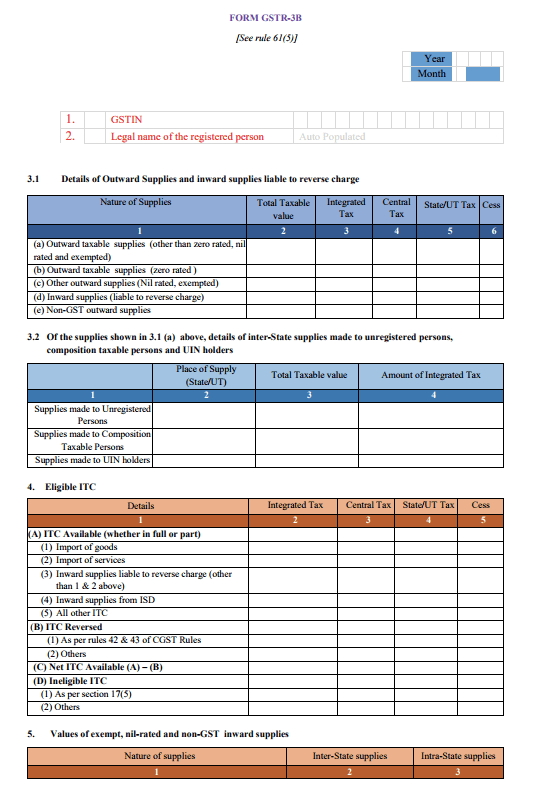

GSTR-3B is a simplified GST return, in which outward supplies and inward supplies are not matched. Hence, the taxpayer while filing GSTR-3B return is required to furnish details of both outward supplies and inward supplies. The table below shows the details that must be submitted in GSTR-3B return.

3.1 Details of outward supplies and inward supplies liable to reverse charge

| Nature of Supplies |

Total Taxable Value

|

Integrated Tax

|

Central Tax

|

State/UT Tax

|

Cesss

|

1

|

2

|

3

|

4

|

5

|

6

|

| (a) Outward taxable supplies (other than zero rated, nil rated and exempted) | |||||

| (b) Outward taxable supplies (zero rated ) | |||||

| (c) Other outward supplies (Nil rated, exempted) | |||||

| (d) Inward supplies (liable to reverse charge) | |||||

| (e) Non-GST outward supplies |

Explanation: In the first table, details of both inward and outward supplies must be provided by the taxpayer. Also, all heads must be broken down into the categories of taxable value, IGST, CGST, SGST and Cess.

For example, if a taxpayer issued invoices worth Rs.1 lakhs in the month of July and collected Rs.18000 as IGST, then in row (a), total taxable value, Rs.1 lakh must be mentioned. The IGST of Rs.18000 collected must be mentioned in row (a) under the heading Integrated Tax.

Similarly, all zero rated supplies must be mentioned in row (b), NIL rated outward supplies must be mentioned in row (c), inward supplies wherein reverse charge is applicable must be mentioned in row (d) and Non-GST outward supplies must be mentioned in row(e).

3.2 Of the supplies shown in 3.1 (a) above, details of inter-State supplies made to unregistered persons, composition taxable persons and UIN holders

| Place of Supply (State/UT) | Total Taxable value | Amount of Integrated Tax | |

| Supplies made to Unregistered Persons | |||

| Supplies made to Composition Taxable Persons | |||

| Supplies made to UIN holders |

Explanation: In the second table, details of supplies already listed in 3.1 (a) is further broken down. This table would be applicable only if the taxpayer made taxable supplies to unregistered persons, composition taxable persons or UIN holders.

For supplies made to unregistered persons, the total taxable value and amount of integrated tax collected must be provided for by place of supply or State. The same breakup must also be provided for supplies made to composition taxable persons and UIN holders. UIN is provided to embassies, consulates and UN bodies.

4. Eligible Input Tax Credit (ITC)

Integrated Tax

|

Central Tax

|

State/UT Tax

|

Cess

| |

| (A) ITC Available (whether in full or part) | ||||

| (1) Import of goods | ||||

| (2) Import of services | ||||

| (3) Inward supplies liable to reverse charge (other than 1 & 2 above) | ||||

| (4) Inward supplies from ISD | ||||

| (5) All other ITC | ||||

| (B) ITC Reversed | ||||

| (1) As per rules 42 & 43 of CGST Rules | ||||

| (2) Others | ||||

| (C) Net ITC Available (A) – (B) | ||||

| (D) Ineligible ITC | ||||

| (1) As per section 17(5) | ||||

| (2) Others |

Explanation: In this table, the taxpayer must provide details of all eligible input tax credit. In part (A), the taxpayer should provide details of input tax credit available with the breakup of IGST, CGST, SGST and Cess. In addition, details of eligible input tax credit must be provided under the following heads:

- Import of goods

- Import of services

- Inward supplies liable to reverse charge (other than 1 & 2 above)

- Inward supplies from ISD

- All other Input tax credit available

Input Tax Credit Reversed: Rule 42 of the CGST rules pertain to the procedure for determination of input tax credit on inputs or input services and input tax credit reversal. This section would be applicable for inputs being partly used for the purposes of business and partly for other purposes, or partly used for effecting taxable supplies including zero rated supplies and partly for effecting exempt supplies.

Rule 43 of the CGST rules pertain to the manner of determination of input tax credit for capital goods. This section would be applicable for the taxpayer claiming input tax credit on capital goods, which are being partly used for the purposes of business and partly for other purposes, or partly used for effecting taxable supplies including zero rated supplies and partly for effecting exempt supplies.

Net Input Tax Credit Available: By netting-off, the available input tax credit and input tax credit reversed, the taxpayer would arrive at net input tax credit available.

Ineligible Input Tax Credit: For certain items like transportation of goods, health club memberships, travel benefits extended to employees and food, input tax credit cannot be claimed. All such ineligible input tax credit under Section 17(5) of the CGST Act and other notification must be listed.

5. Values of exempt, nil-rated and non-GST inward supplies

| Nature of Supplies |

Inter-State Supplies

|

Intra-State Supplies

|

| From a supplier under composition scheme, Exempt and Nil rated supply | ||

| Non GST supply |

Explanation: In this table, value of inward supplies that are nil-rated or non-GST inward supplies received by the taxpayer must be mentioned.

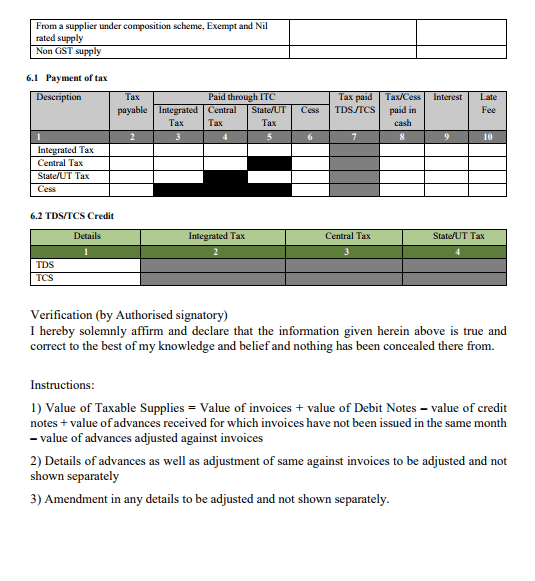

6.1 Payment of tax

| Description |

Tax Payable

| ITC ClaimIntegrated Tax | ITC Claim Central Tax | ITC Claim State/UT Tax | Cess | Tax Paid TDS/TCS | Tax/Cess Paid in Cash | Interest |

Late Fee

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

8

|

9

|

10

|

| Integrated Tax | NA | ||||||||

| Central Tax | NA | NA | |||||||

| State/UT Tax | NA | NA | |||||||

| Cess | NA | NA | NA | NA |

Explanation: In this table, details of GST paid by the taxpayer must be mentioned with the breakup of IGST, CGST, SGST and Cess. Since TDS and TCS provisions have not been implemented, column 7 need not be filled-in. In column 3, 4 and 5, the taxpayer can set-off GST liability with available input tax credit. ince SGST input tax credit

Since SGST input tax credit cannot be used for CGST payment, the cell is listed as NA. Similarly, CGST input tax credit cannot be used for SGST payment and the cell is listed as NA.

6.2 TDS/TCS Credit

| Details |

Integrated Tax

|

Central Tax

|

State/UT Tax

|

| TDS |

NA

|

NA

|

NA

|

| TCS |

NA

|

NA

|

NA

|

Explanation: In this table, details of TDS and TCS credit available with the taxpayer is listed. As mentioned above, since TDS or TCS provisions have not been implemented, this table need not be completed.

GSTR-3B Return

A sample GSTR-3B return is reproduced below for reference:

How to file GSTR-3B Return?

GSTR-3B return can be filed online through the GST Common Portal or using LEDGERS GST Software. Based on the invoices raised and purchases invoices recorded, GSTR-3B return can be prepared easily.

Comments

Post a Comment